Book Launch: Welcome by Eoin Murray

Eoin Murray, Head of Investment at Federated Hermes Limited, delivered a brilliant welcome remotely due to unforeseen travel disruptions. He emphasised the seminal nature of Dr. Papazian’s work, discussing it within the context of the evolution of finance theory and mathematics in the last six or so decades. Below you can find the full text of his speech.

Thank you, Armen, for asking me to speak at your book launch this evening – it is my absolute honour to do so and I am extremely sad that I could not be there in person for this wonderful event. It is entirely justified that your book is gaining such attention. I think that it is fair to say that updates to our thinking about finance and investment are rarer than hen’s teeth. For asset pricing and portfolio theory, we find the foundational elements in the Efficient Markets Hypothesis and the Capital Asset Pricing Model based on work by such luminaries as Markowitz, Sharpe, Lintner, Treynor and Miller back in the 1960s. Building on that, work in the 70s and 80s gave us a better understanding of factor modelling (down to academics such as Fama, French, Carhart and others) and derivatives pricing (led principally by engineers like Black and Scholes). By the time we get to the 90s, psychologists and behavioural scientists had become involved, individuals like Thaler, Kahneman and Barberis, keen to explain pricing anomalies that did not fit the prevalent patterns through reference to behavioural finance. All in all, I think you will agree, very few seminal pieces of work over the course of the last six decades have caused us to rethink our approach.

So it is entirely appropriate that we shine a bright light on ‘Hardwiring Sustainability into Financial Mathematics’ by Dr Papazian, as representing the first serious attempt, along with his earlier work ‘The Space Value of Money’ published last year, to bring financial and investment theory into the modern world. Finance and investing cannot exist in isolation and it is imperative that we try to improve our knowledge of assets, portfolios and markets by incorporating an understanding of how they interact with some of the greatest challenges that our society faces today, namely climate change and biodiversity and ecosystem loss.

This work is not just a simple update to our existing thinking, but a different approach altogether, one that leaves us far better equipped to overcome the hurdles that confront us. Regulators, corporates and governments are in full flight, as we witness events unfold this week in Dubai at COP28, and it is incumbent on the investment industry to do its bit, to play its part. To do so, we need a new framework, and that is what Armen has provided us with, a theoretical treatise and a set of new equations that incorporate the broad concept of sustainability with that of markets.

To get our heads around the alphabet soup that we face, whether its accounting standards like ISSB, SASB or VRF, or disclosure regimes like TCFD, TNFD or CSRD, or just reporting requirements like IFRS and ESRS, we need to think harder about how we practically integrate the implications of emissions’ trends, of pollution, of nature loss, into our decisions about capital deployment, asset allocation and risk management. From there, too, we can properly begin to reflect on the broader implications for macroeconomic policy and implementation. This is what the book brings.

Armen, I have two specific hopes for this excellent work. Firstly, that it becomes a standard textbook in every college and university for any student of finance. Secondly, that we remember that we have a responsibility to our clients, the pensioners, insurers and savers, to incorporate your learnings in order to do the best job that we can for them. It is our modern fiduciary duty.

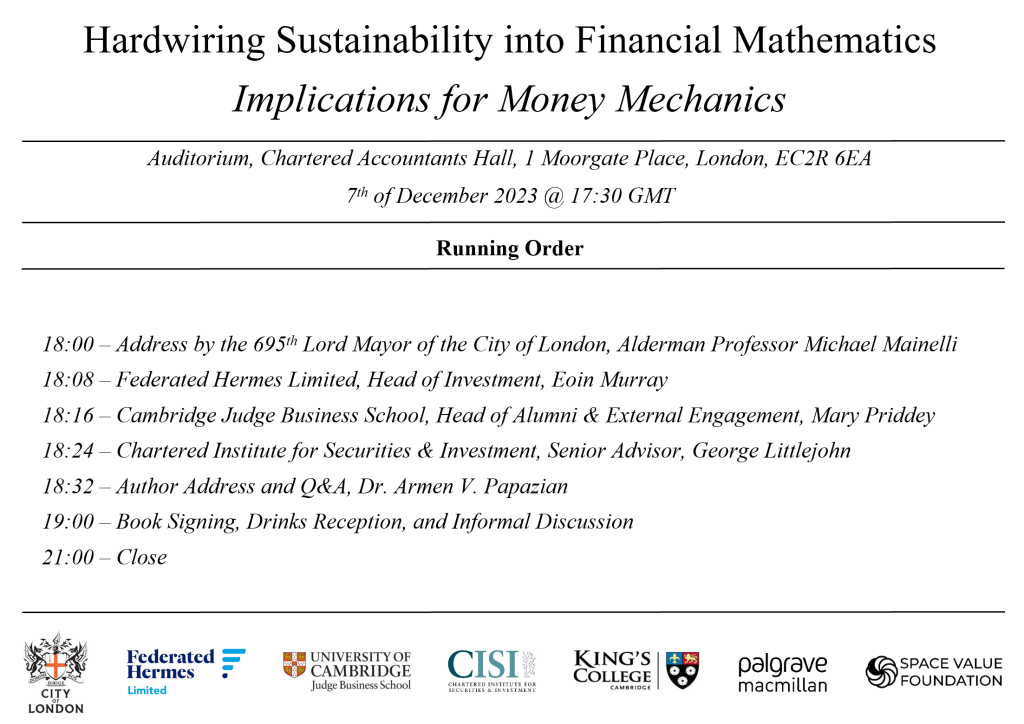

Event Agenda

About the Book

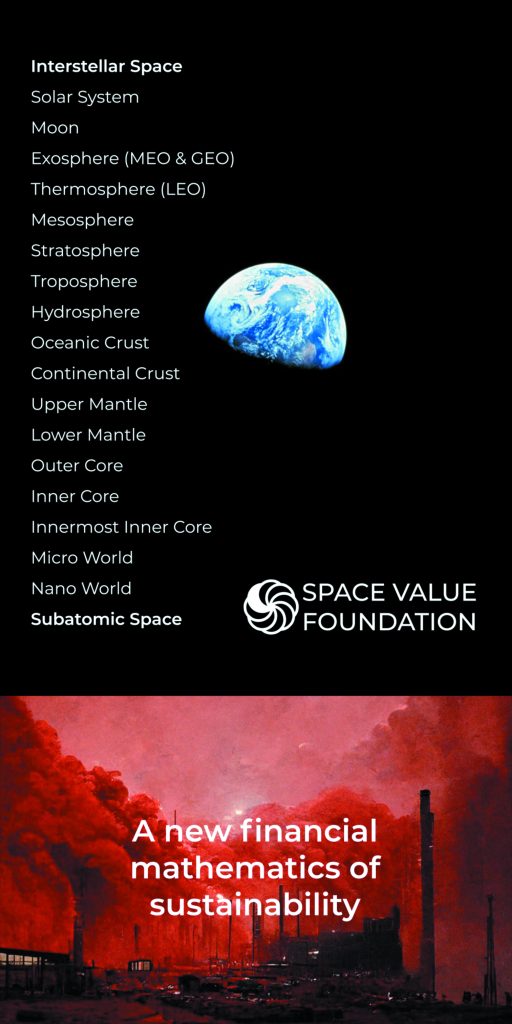

A ground-breaking work that addresses a crucial challenge facing our planet and the finance discipline, this book discusses key omissions in finance theory, principles, and equations, and explores recent developments in sustainable finance/ESG integration. It reveals a spaceless analytical framework and a sustainability debate that avoids the very logic of money creation. A theoretical treatise on sustainability in finance, the book makes the case for the hardwiring of sustainability into financial mathematics, offering a complementary principle and new equations for the purpose, while also discussing the implications of such a transformation for money mechanics.

CJBS Announcement

The Cambridge Judge Business School has recently published a news announcement regarding the forthcoming release of the book and this launch event – Hardwiring Sustainability.

CISI Article

The Chartered Institute for Securities & Investment has recently published an article by Dr. Armen V. Papazian that summarises the key arguments of his recent book – Sustainability and a space-adjusted mathematics of value and return.

About the Author

Armen is a financial economist, author, consultant and innovator with a track record in global finance and more than 20 years’ experience in sustainable finance, capital markets, and analytics. Armen is a Doctor of Financial Economics from Cambridge University and couples extensive advisory experience for financial institutions and markets with research into both the academic and practical aspects of sustainable finance challenges. More

He is the author of The Space Value of Money: Rethinking Finance Beyond Risk and Time (2022) and a founder of the Space Value Foundation, which campaigns to embed sustainability into the very core equations of finance, allowing a global transition in business and industry.

The Space Value Foundation takes its name from the principle and model proposed by Armen in his recently published book.