A Risk and Time focused financial value framework that ignores Space as an analytical dimension (and our physical context) has driven us into an evolutionary bottleneck.

For true sustainability to stand a chance, the Risk and Time Value of money model must evolve. It must account for space and our responsibility for human impact in it and on it. This can only happen if the mathematics through which we design, create, and allocate money and investments matches our strategic commitments.

We need a new framework. One that integrates responsibility into the financial mathematics through which we design, measure, value and execute investments.

The Space Value of Money introduces a fresh and innovative perspective on sustainability and finance. It expands our financial value framework, previously built around risk and time. It factors in space as an analytical dimension and our physical context.

The proposed principle and metrics embed our responsibility for space impact into our value equations. Thus, they making finance inherently sustainable. They also allow our sustainability models to incorporate many more relevant aspects than E, S, and G (Environmental, Social, Governance Factors). Like, Technology (T) and Money (M).

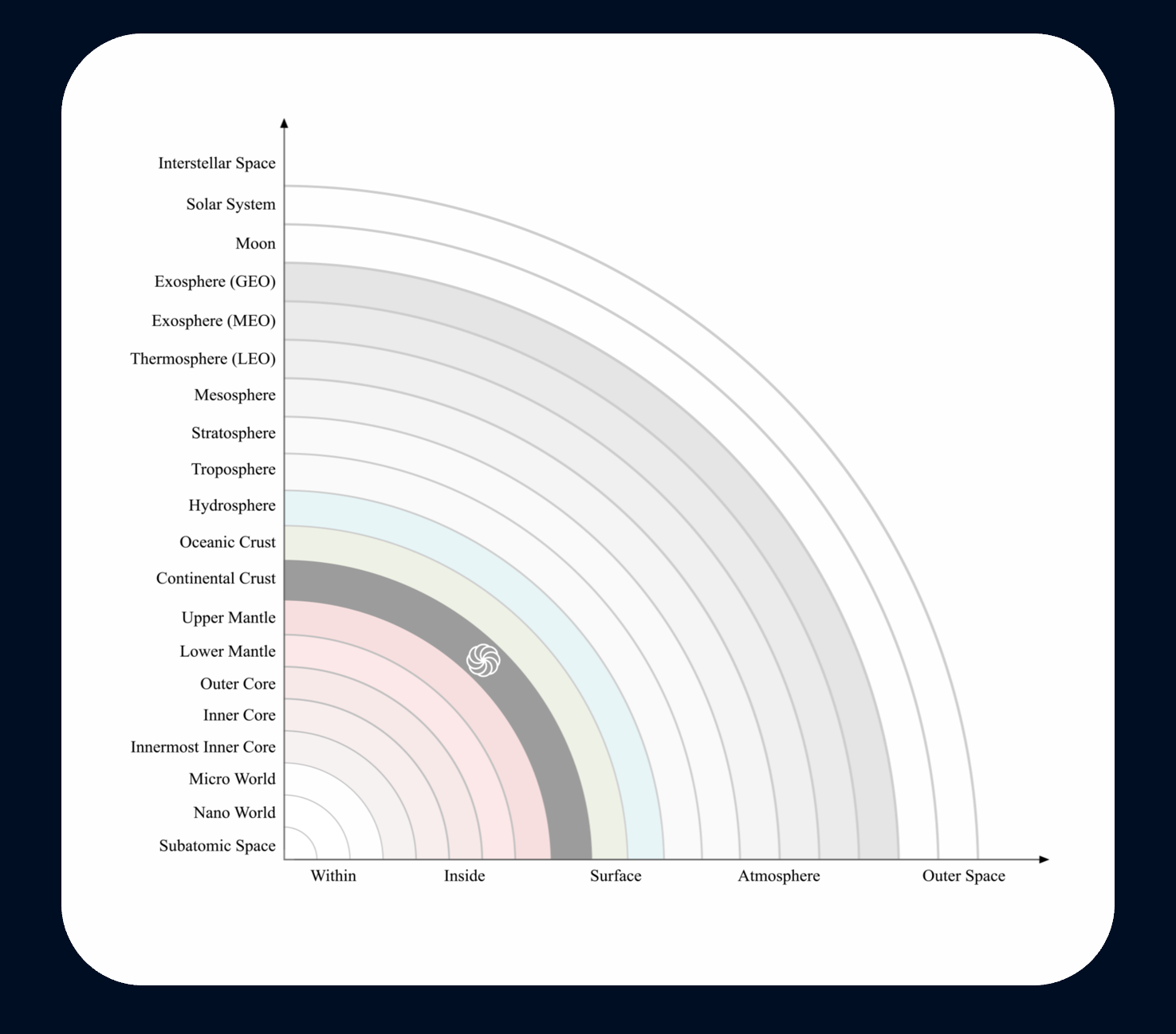

The SV Framework introduces the dimension of space into our models and takes into account the many different layers of space we operate in or affect.

The Space Value of Money Principle

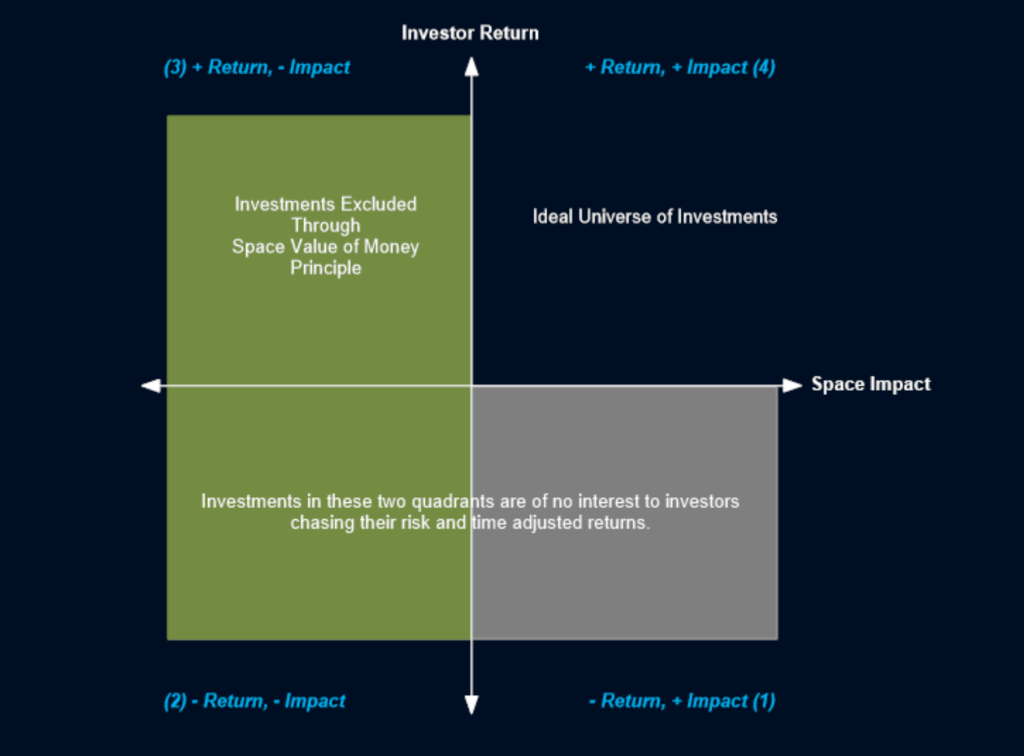

The Space Value of Money principle establishes a bottom threshold of investment acceptability. It requires that investors achieve their positive returns without negative space impact.

The Space Value of Money principle requires that a dollar ($1) invested in space has at the very least a dollar’s ($1) worth of positive impact on space.

The TRIM: Transition Return Impact Map

The Transition Return Impact Map is a conceptual representation of the Net Zero transition. It is expressed in terms of Investor Return and Space Impact. The map explains the conceptual role of the Space Value of Money principle in establishing the responsibility of the investor and the bottom threshold of investability. Positive private returns should be pursued within the universe of projects and investments that have a positive or neutral space impact.

The Space Value of Money principle introduces spatial responsibility into core finance equations. It requires that our mathematical expressions of value reflect that fact. Space Value metrics therefore offer a framework of value where impact is integral to return. Where the Risk-Averse Investor is not the sole stakeholder of our mathematical expressions of value. Where a Pollution Averse Planet and an Aspirational Human Society are equal stakeholders.

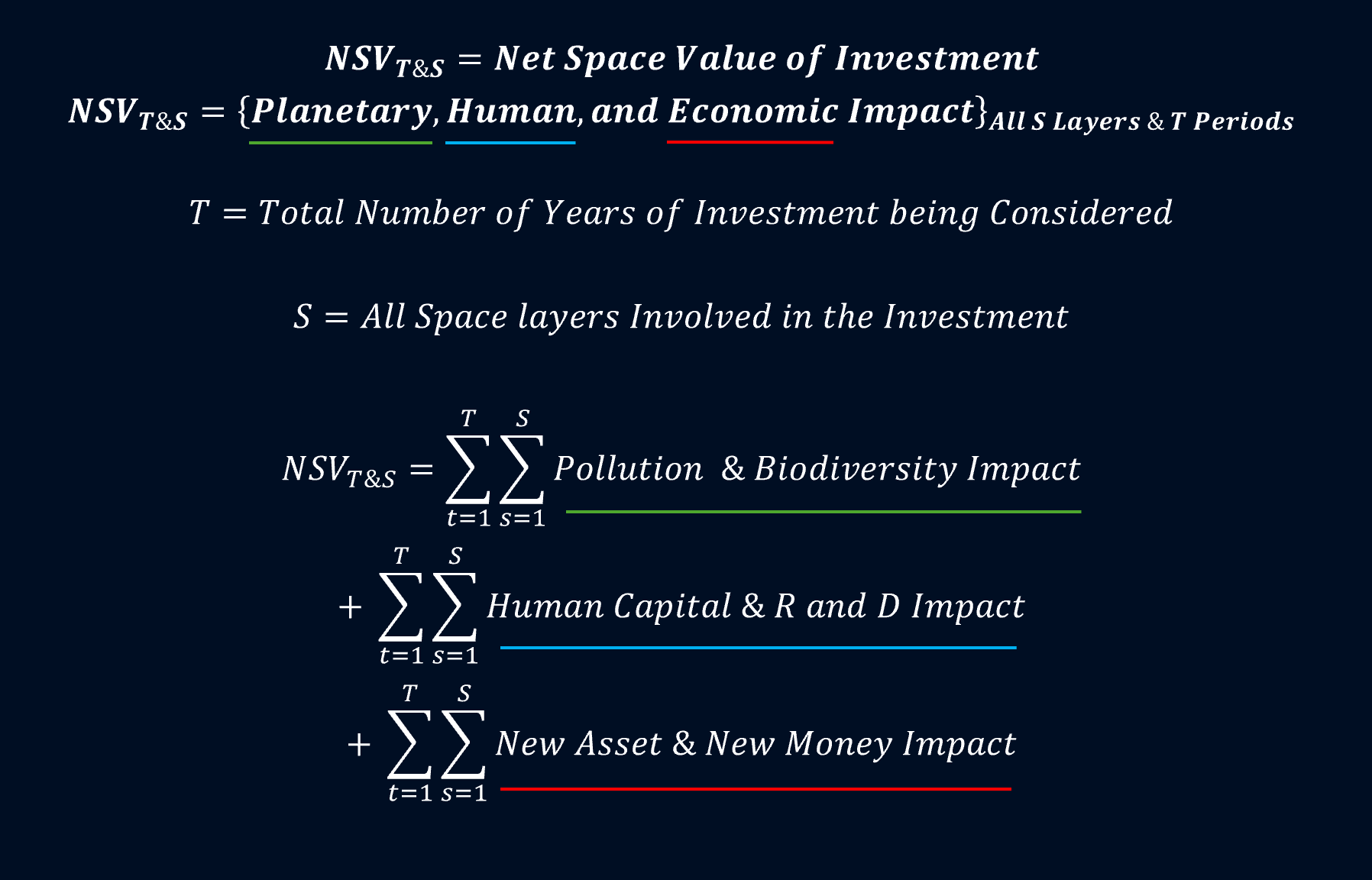

- On the broadest conceptual level, taking into account the interests and priorities of all the above equal stakeholders, the space impact of an investment is defined as follows:

Planetary, Human, and Economic impact

Across all space layers involved

Across all time horizons involved

Space Layers

Impact must be measured across ALL space layers. Anything less encourages investors to opt for narrow interpretations of impact. Indeed, frameworks that do not approach impact from a multi layered space perspective, may very well be creating new blind spots which can have catastrophic implications for different environments in the future.

The above chart provides high level definitions of space layers. A closer consideration of specific layers is necessary when assessing the impact of different activities, industries and value chains. The below table is a closer look at the continental crust and hydrosphere – taking into account sublayers that may be relevant for a specific investment impact analysis.

Accounting For Space Impact

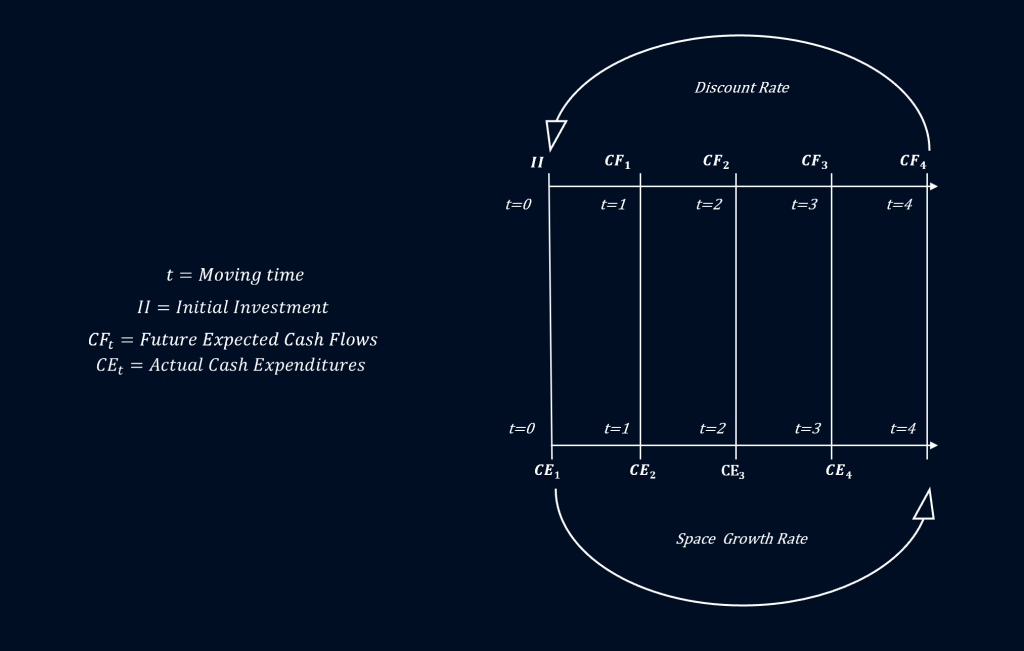

The first step towards a transformed financial mathematics that accounts for the space impact of cash flows is the introduction of the double timeline into our financial valuation and modelling exercises.

The double timeline integrates the space impact of the cash flows into the conventional risk and time assessment of the cash flows. Through the space timeline, the multi-layered space impact of the cash flows is mapped, tracked, and quantified.

While the discounting of future expected cashflows remains relevant, the compounding of the space impact of cash flows complements the analysis. Based upon the below impact equations, the space value framework also introduces the Space Growth Rate.

The Space Value Metrics

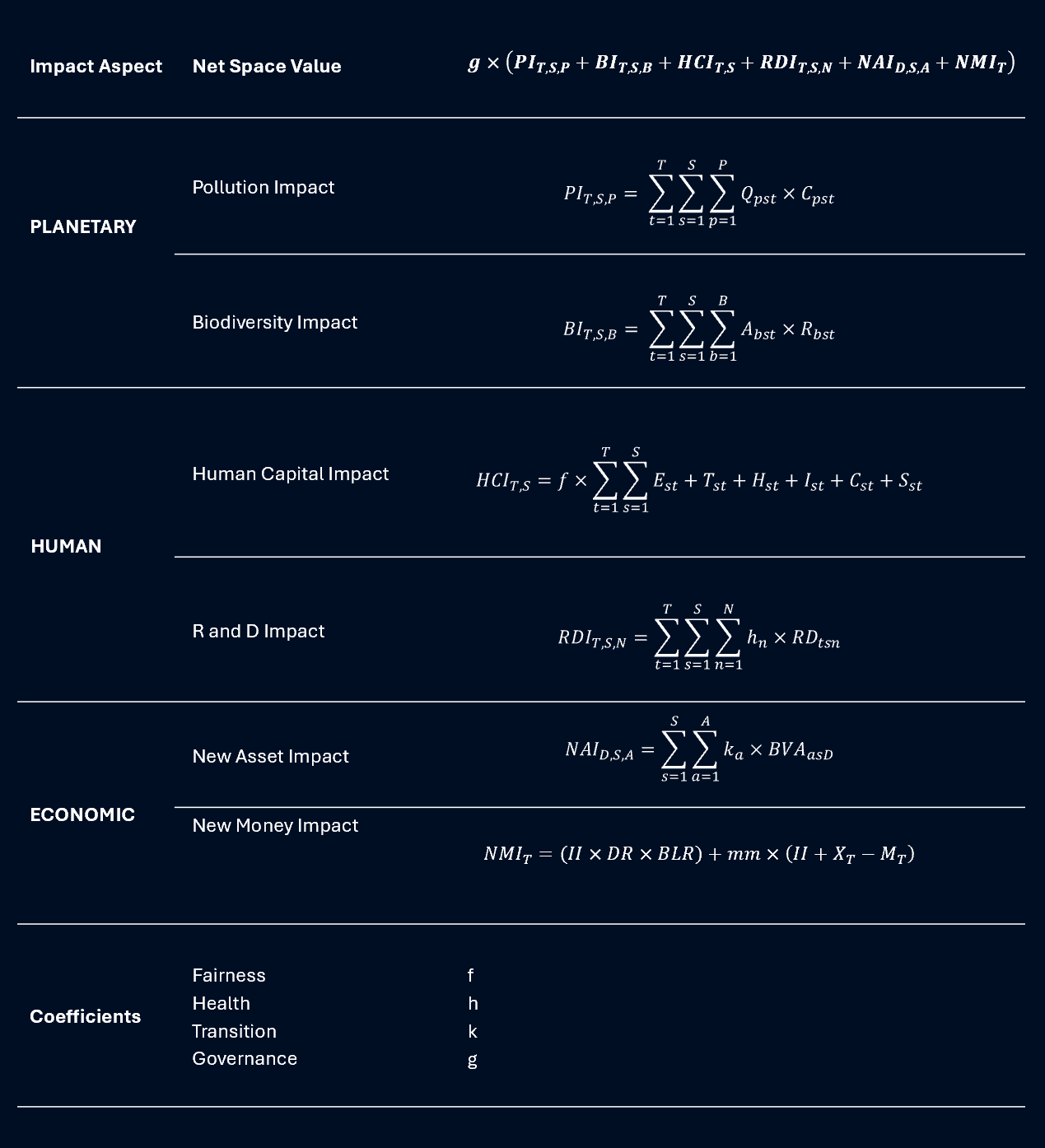

The Net Space Value aggregates the planetary, human, and economic impact of investments, measured through the pollution, biodiversity, human capital, research and development, new asset and new money impacts of the cash flows.

Naturally, each of these elements are further defined through corresponding equations. The below table provides the equations for each of the elements in the Net Space Value of investments.

The consideration of the impact of cashflows across space layers denoted by the second sigma is one of the key contributions of the SV Framework. The layered analysis of space impact is critical from four key perspectives:

- Value Chain

- Impact Intensity

- Clean Up Technology; and

- Costs

You can learn more about the educational and consulting services we provide by following the links.

We would love to show you more...

Please feel free to get in touch! info@spacevaluefoundation.com