One of the most frequently asked questions we face at the Space Value Foundation is ‘Why Space?’ Given the importance and critical relevance of the question, we elaborate below.

Learn More through the Publications and SV Framework pages.

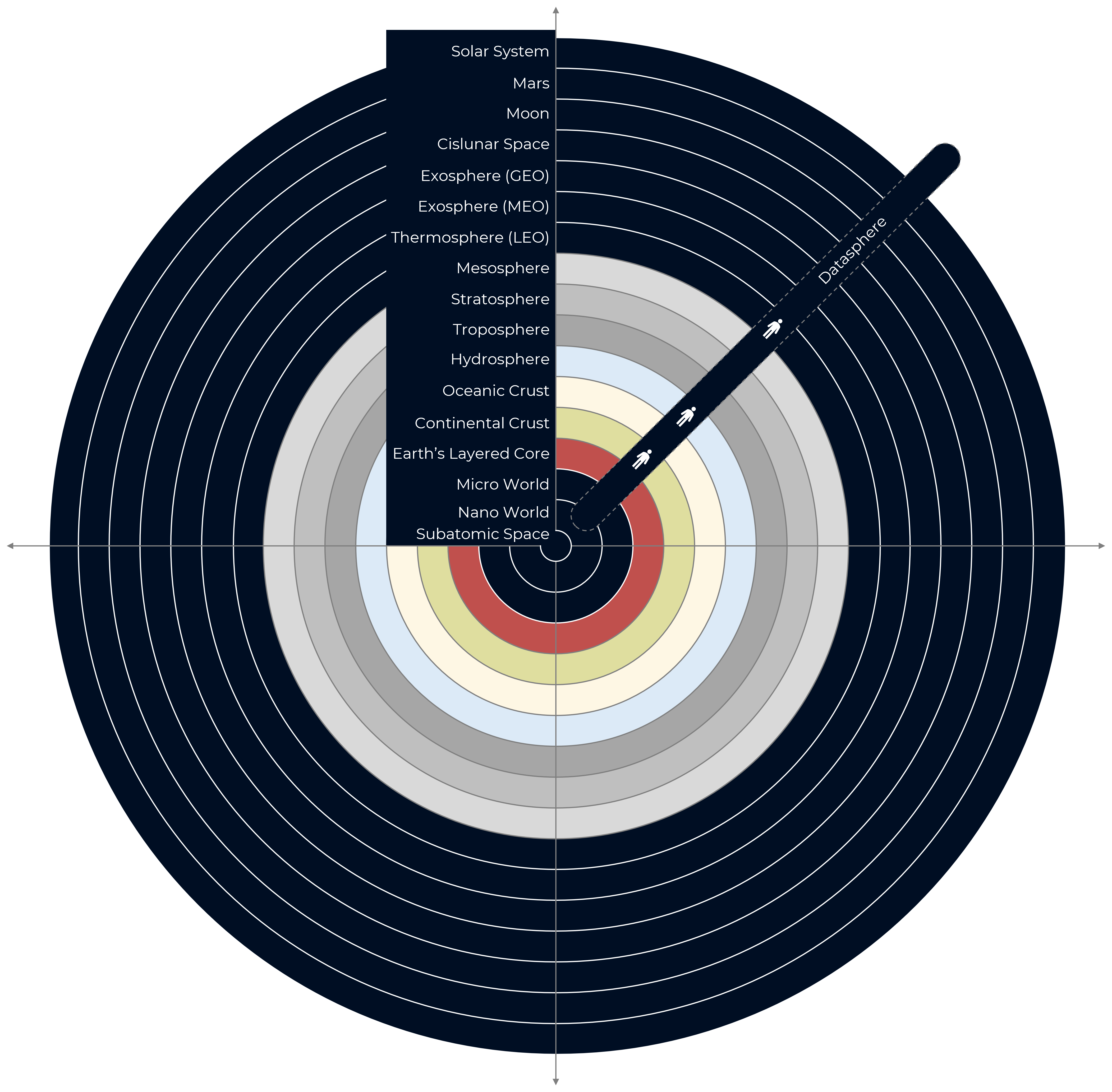

What is Space in the Space Value of Money

Space is not just ‘outer space’, it is our physical and molecular context of matter, irrespective of constitution, composition, density, dynamics, and temperature, stretching from subatomic to interstellar space and every layer in between and beyond.

Space Layers

Naturally, the above conceptualisation of space is a conceptualisation. It main function and benefit is to facilitate the analytical solutions that the Space value framework provides. Moreover, each of the above identified layers can be further defined through sublayers. The benefit of

- Interstellar Space

- Solar System

- Mars

- Moon

- Cislunar Space

Note: Based on the Kármán line, the theoretical line that defines the boundary between outer space and national airspaces (100km above sea level), outer space begins somewhere in the Thermosphere.

- Exosphere: Geostationary orbit (GEO)

- Exosphere: Medium Earth Orbit (MEO)

- Thermosphere: Low Earth Orbit (LEO)

- Mesosphere

- Stratosphere

- Troposphere

Note: Based on the Kármán line, the theoretical line that defines the boundary between outer space and national airspaces (100km above sea level), outer space begins somewhere in the Thermosphere.

- Hydrosphere

- Oceanic Crust

- Continental Crust

- Upper Mantle

- Lower Mantle

- Outer Core

- Inner Core

- Innermost Inner Core

- Microworld

- Nano World

- Subatomic Space

- On Land

- In and On Water

- In Zero Gravity

- Datasphere

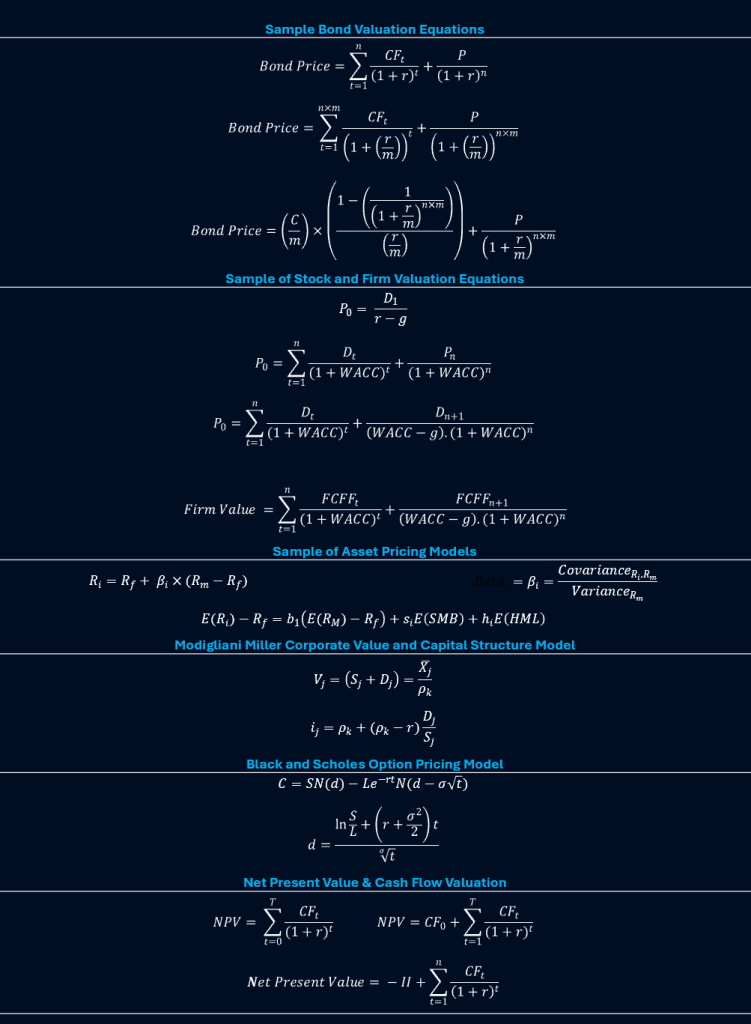

Space: The Missing Dimension in Financial Mathematics

Space is our physical context, stretching from subatomic to interstellar space and every layer in between and beyond, and it is also a dimension of analysis currently missing from our equations of value and return – built around risk and time. Below is a selection of core finance equations that support this proposition. There are no context parameters in any of them, our physical context is absent from our core equations of value and return. Our current financial value framework and mathematics are built in Risktime, without context parameters, without space.

See Brealey, Myers, and Allen (2020), Pike, Neale, Akbar, and Linsley (2018), Watson and Head (2016), Williams (1938), Fama and French (1996, 2004, 2015), Gordon (1959), Gordon and Gordon (1997), Gordon and Shapiro (1956), Markowitz, (1952), Modigliani and Miller (1958), Ross (1976), Roll and Ross (1980), Sharpe (1964), Lintner (1965), Merton, (1973), Black and Scholes (1973), Nobel Prize (1997), Koller et al. (2015, 2011), Choudhry (2012, 2018), Damodaran (2012, 2017), Yescombe (2014), Rosenbaum and Pearl (2013), Isaac and O’Leary (2013) and others. See Papazian (2023, 2022) for a detailed discussion of the above, and the absence of space and space impact.

Indeed, our financial value framework has considerable responsibility to bear for the multitude of environmental, ecological, and social crises we face today. Planet and humanity have never been equal stakeholders in our equations and models. Indeed, our equations to date have focused on the time and risk value of future expected cash flows, never their multi-layered and multidimensional impact on space.

Thus, by introducing Space into finance, as an analytical dimension and our physical context, by incorporating space parameters into the logic of the value of money, by integrating the space impact of cash flows into the value of cash flows, we may be able to change trajectory, transform human productivity, and secure its sustainability and continuous expansion across time and space.

Focused on Risk value and Time value, our models appear to be designed without any contextual parameters. Based on the ‘Risk and Return’ and ‘Time Value of Money’ principles, which serve the mortal risk-averse investor, our financial mathematics omits space and our responsibility for impact on it and in it.

Space Layers and Impact

Introducing Space into finance as a dimension of analysis involves recognising the many layers of space. This is a crucial differentiating factor in the measurement of impact within the Space Value Framework.

When we assess human activity impact, we cannot be both one dimensional and sustainable. This is true and critical in terms of the pollutants and biodiversity losses we consider, but also the layers of space we take into account when exploring and quantifying impact.

“It’s carbon emissions we need to worry about…” is true when addressing the climate crisis but not when it comes to the long term effect of nanotechnologies or microplastics in the food chain. Emissions do not account for the multiplication of orbiting debris and are only a contributor to the catastrophic biodiversity impact of pollution in the hydrosphere.

If we are to move towards true and effective sustainability, we must have a framework that conceptualises impact authentically and comprehensively and addresses it within the context of space and its many layers. In truth, many space layer impacts slip under the radar of most modern understandings of ‘impact’.

The layered analysis is important from four key perspectives:

Because the value chains of investments affect different layers of space differently.

Two shipping companies based in New York, one transports its cargo with aeroplanes and the other with ships. One affects the hydrosphere and the other the stratosphere. We need a framework that recognises this difference in the layers of space different value chains affect.

Because the intensity of impact differs across space layers.

GHG emissions in the stratosphere do not have an identical impact to GHG emissions on the surface of the planet. The impact of GHG emissions in overcrowded cities differs from the impact of GHG emissions in open fields.

Because cleaning the same pollutant in different space layers involves different technologies.

Cleaning plastic waste from our oceans, from our rivers, from our streets, and from our food chain require entirely different technologies. Cleaning the carbon from the air and cleaning the debris in orbit require entirely different technological toolkits still to be invented.

Given all of the above, the costs of impact differ across different layers of space, even for the same pollutant or type of waste.