The carbon in our air, the plastic in our oceans, the sewage in our rivers and beaches, the waste in and on our lands, the debris in orbit… they are all, individually and collectively, the statistically significant evidence of the necessity to reinvent human productivity. This task, a monumental and evolutionary challenge, is now irreversibly on the global agenda.

Before and since COP26, the Race to Zero, the Glasgow Financial Alliance for Net Zero (GFANZ), the Taskforce on Climate-related Financial Disclosures (TCFD), the International Sustainability Standards Board (ISSB) and many other initiatives have been actively developing new frameworks and standards through which we can conceptualise and operationalise sustainability and meet our Net Zero targets by mid-century.

Interestingly, however, the rise to prominence of sustainable finance, the frameworks, the standards, the temperature scores, and the ratings have yet to penetrate and transform the analytical content of core finance theory and practice – the principles and equations of value and return we have taught and applied in finance for the last many decades.

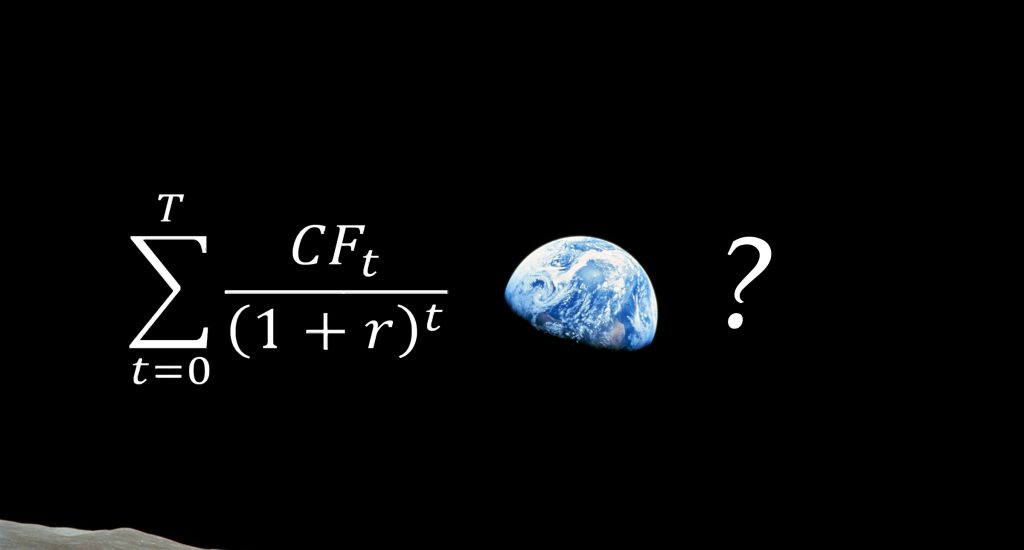

In other words, despite our best intentions and efforts, companies, investors, markets, and governments remain at the mercy of a financial value framework built around risk and time – a framework that has to date allowed and tolerated the littering of our space and its many layers.

Reinventing human productivity requires a radical change in our financial value framework, and the equations of value and return that govern the creation, allocation, and deployment of money are key to the transformation.

Without changing the mathematics of value and return that supports billions of financial and investment decisions on this planet, our sustainability efforts will remain tangential. If our financial mathematics is to reflect our new sustainability objectives and Net Zero targets, then our equations of value and return must also change and reflect our new priorities.

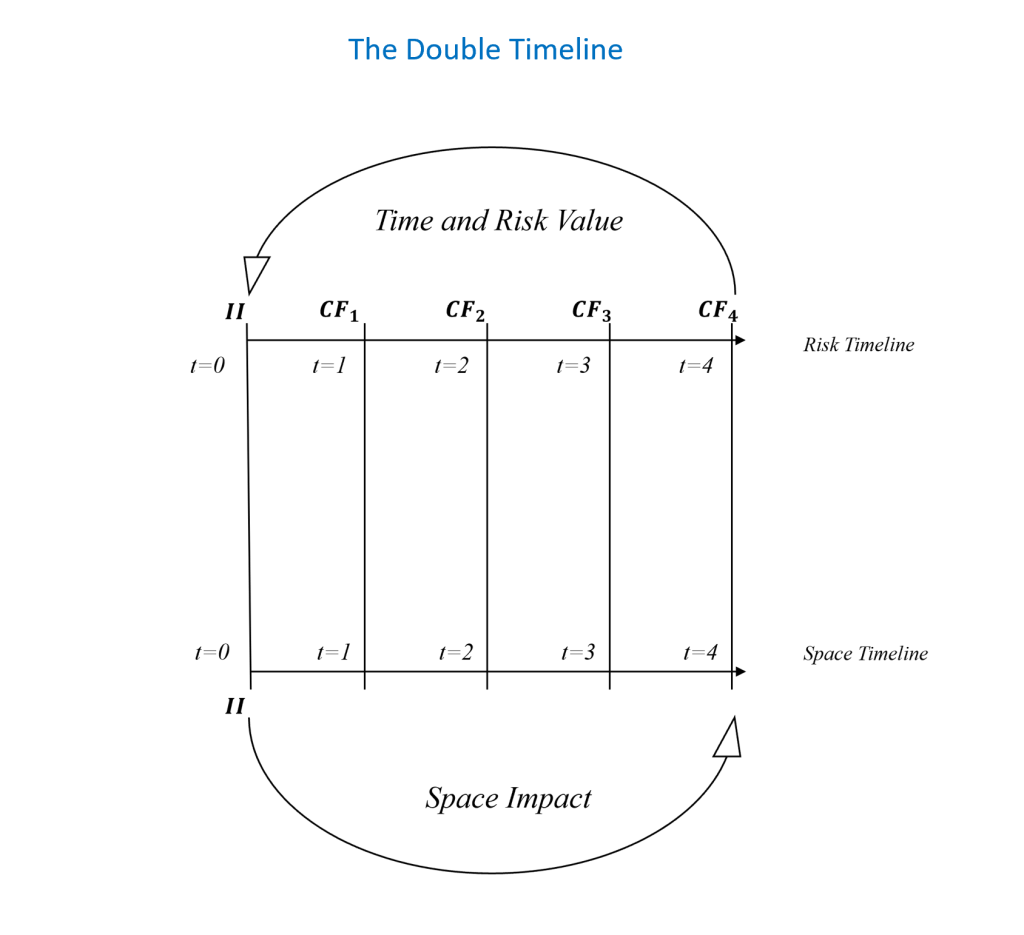

The analytical framework of core finance theory and practice has been built around risk and time, based on the principles of Time Value of Money and Risk and Return. Indeed, our current financial value framework omits space as an analytical dimension and our physical context. It reveals a risktime universe where the value of money is defined by and through the risk and time features of the cash flows involved. A framework that discriminates against our evolutionary investments, which by their very nature and risk/time profile are in a blind spot and at odds with the current principles and equations of finance.

We need to introduce space as an analytical dimension, establish our responsibility of impact on space, and adjust our equations to also account for the space impact of cash flows.

The first step towards a transformed framework of value is the introduction of a new principle that establishes our responsibility for space impact – the Space Value of Money.

The Space Value of Money principle requires that a dollar ($1) invested in space has at the very least a dollar’s ($1) worth of positive impact on space.

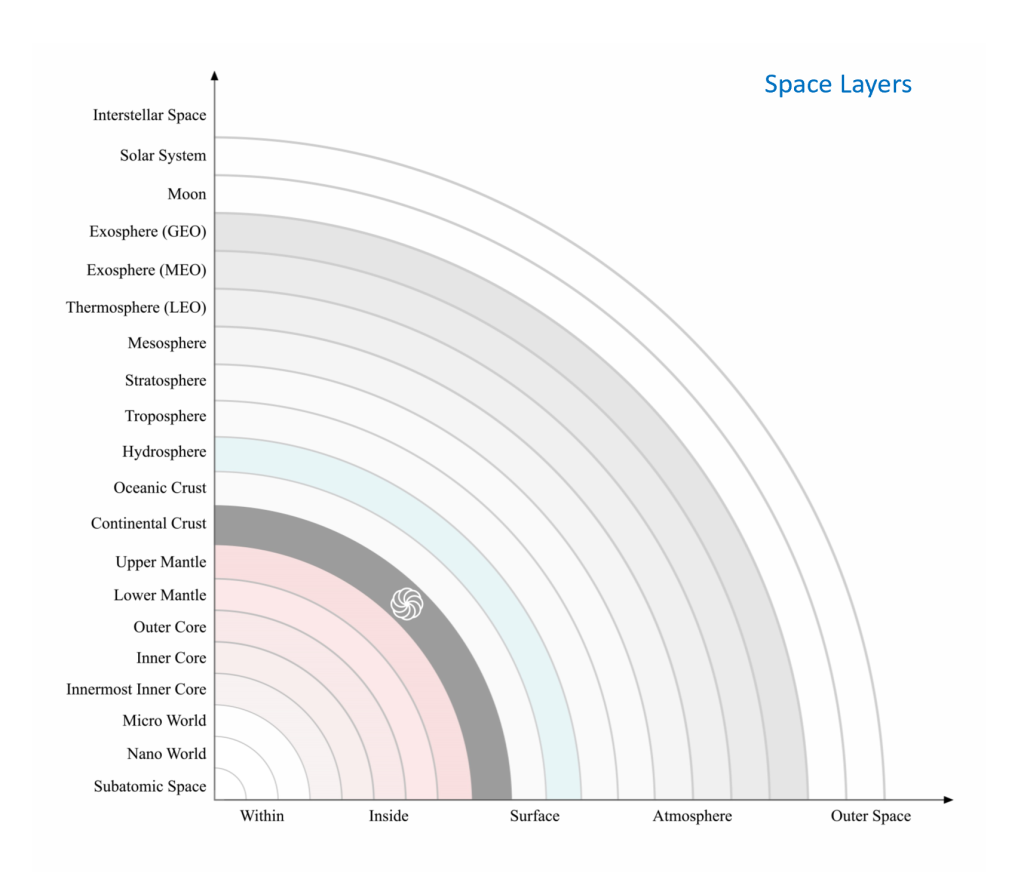

Space here is our physical context – a multi layered reality that stretches from subatomic to interstellar space, and every layer in between and beyond.

Once we establish our responsibility for space impact, we can subsequently develop a financial mathematics of sustainability that will allow us to consistently avoid negative impacts.

Investors remain free to pursue their private returns, but the space impact of investments would be built into the equations that calculate their values and returns. The pollution-averse planet and an aspirational human society would become equal stakeholders of our models alongside the risk-averse mortal investor. In other words, investors can continue discounting their future cash flows and expectations as long as the impact of their investments are considered in the present and compounded into the future when necessary.

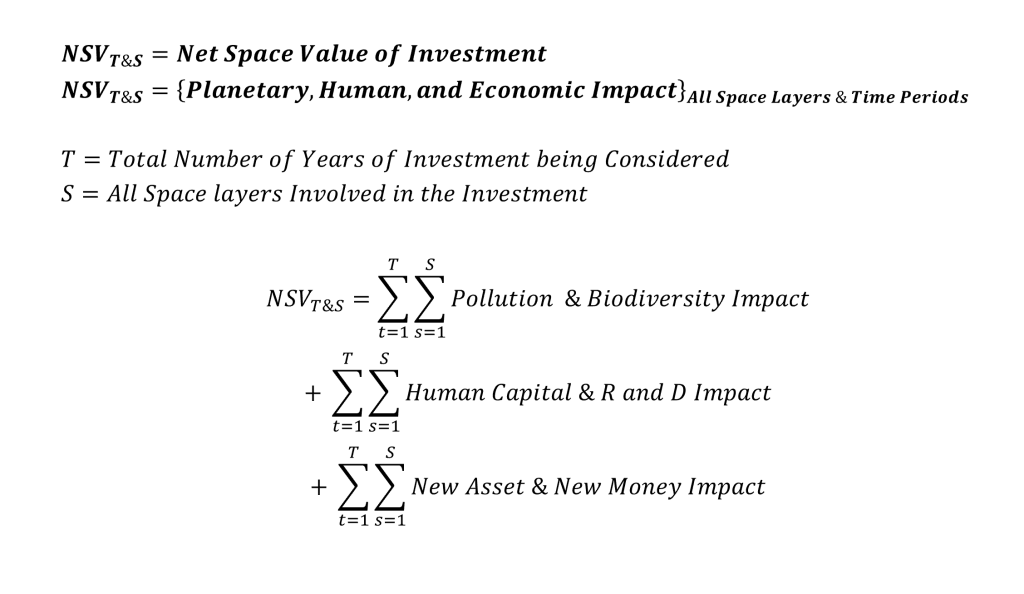

The quantification of space impact across all relevant layers of space, and the integration of impact into our financial decision-making framework and core equations are the technical contributions of the Space Value Framework. The Net Space Value (NSV) of Investment is given below as a conceptual summary of space impact measurement.

The equations for each element and their integration into our current framework and models are discussed in the book (See table of contents below).