Menu

LECTURE: The Monetary Foundations of a Spacefaring Species

Play Video

Watch this insightful lecture by Dr. Armen V. Papazian, author of Hardwiring Sustainability into Financial Mathematics and The Space Value of Money, organised by the Space Renaissance Academy. A special opportunity to explore unique insights into our future.

Dr. Armen V. Papazian

Armen is a financial economist, author, consultant and innovator with a track record in global finance and more than 20 years’ experience in sustainable finance, capital markets, and analytics. Armen is a Doctor of Financial Economics from Cambridge University and couples extensive advisory experience for financial institutions and markets with research into both the academic and practical aspects of sustainable finance challenges.

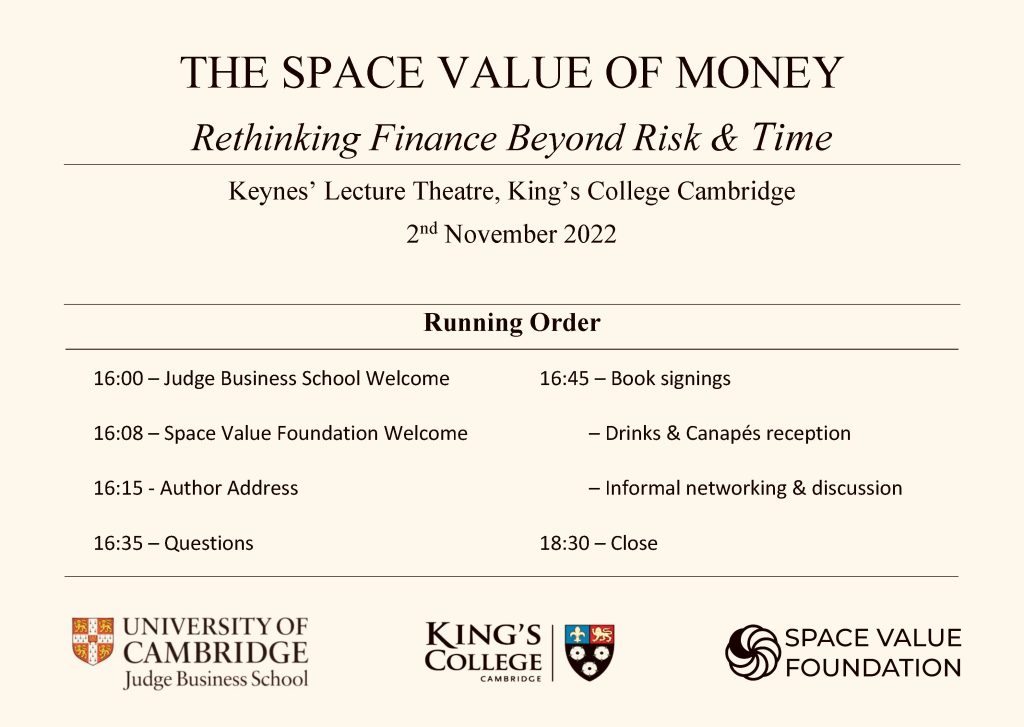

He is the author of Hardwiring Sustainability into Financial Mathematics and The Space Value of Money: Rethinking Finance Beyond Risk and Time (2022) and a founder of the Space Value Foundation, which campaigns to embed sustainability into the very core equations of finance, allowing a global transition in business and industry.

The Space Value Foundation takes its name from the principle and model proposed by Armen in his recently published book. Read More

About the Book: The Space Value of Money

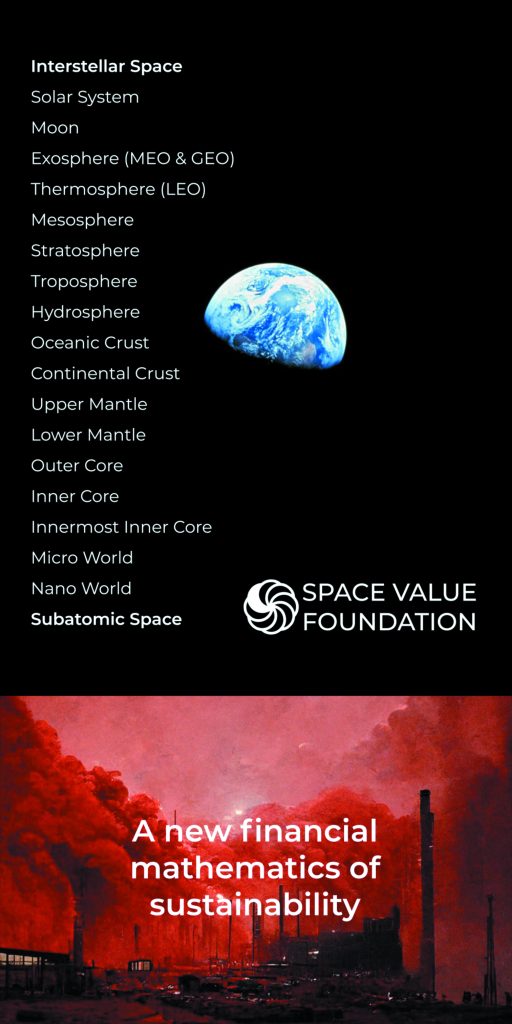

A fresh and innovative perspective on sustainability and finance, the book proposes a change in the logic of the value of money to account for risk, time, and space parameters, and offers an approach through which we can meet the challenges of the Net Zero transition and facilitate long term transformations in human productivity.

The Space Value of Money introduces multidimensional thinking in financial valuation and optimisation, expanding our risk- and time-focused value paradigm in finance. It complements the existing principles, i.e. time value of money and risk and return, by factoring in space and our responsibility for impact on space. The proposed principle and metrics entrench responsibility and sustainability into the core principles and equations of value in finance, making finance inherently sustainable, and acting as a theoretical bridge between core finance theory and the growing field of sustainable finance or ESG integration.

The space value of money principle introduces the necessity and associated metrics to quantify the aggregate space impact of investments, and the methodology to integrate them into our value equations and investment selection process. The framework facilitates the creation and deployment of sustainable finance algorithms in the future and offers alternative solutions to the funding challenges of the transition when applied to our monetary architecture.

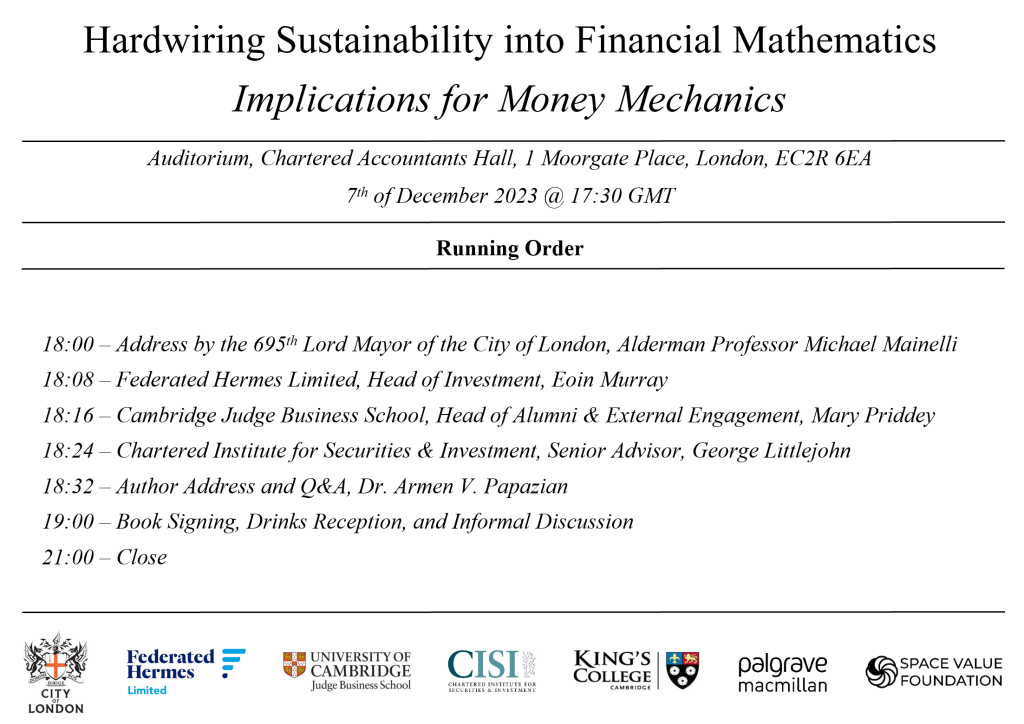

About the Book: Hardwiring Sustainability

A ground-breaking work that addresses a crucial challenge facing our planet and the finance discipline, this book discusses key omissions in finance theory, principles, and equations, and explores recent developments in sustainable finance/ESG integration. It reveals a spaceless analytical framework and a sustainability debate that avoids the very logic of money creation. A theoretical treatise on sustainability in finance, the book makes the case for the hardwiring of sustainability into financial mathematics, offering a complementary principle and new equations for the purpose, while also discussing the implications of such a transformation for money mechanics.

CJBS Announcement

The Cambridge Judge Business School has recently published a news announcement regarding the forthcoming release of the book and this launch event – Hardwiring Sustainability.

CISI Article

The Chartered Institute for Securities & Investment has recently published an article by Dr. Armen V. Papazian that summarises the key arguments of his recent book – Sustainability and a space-adjusted mathematics of value and return.