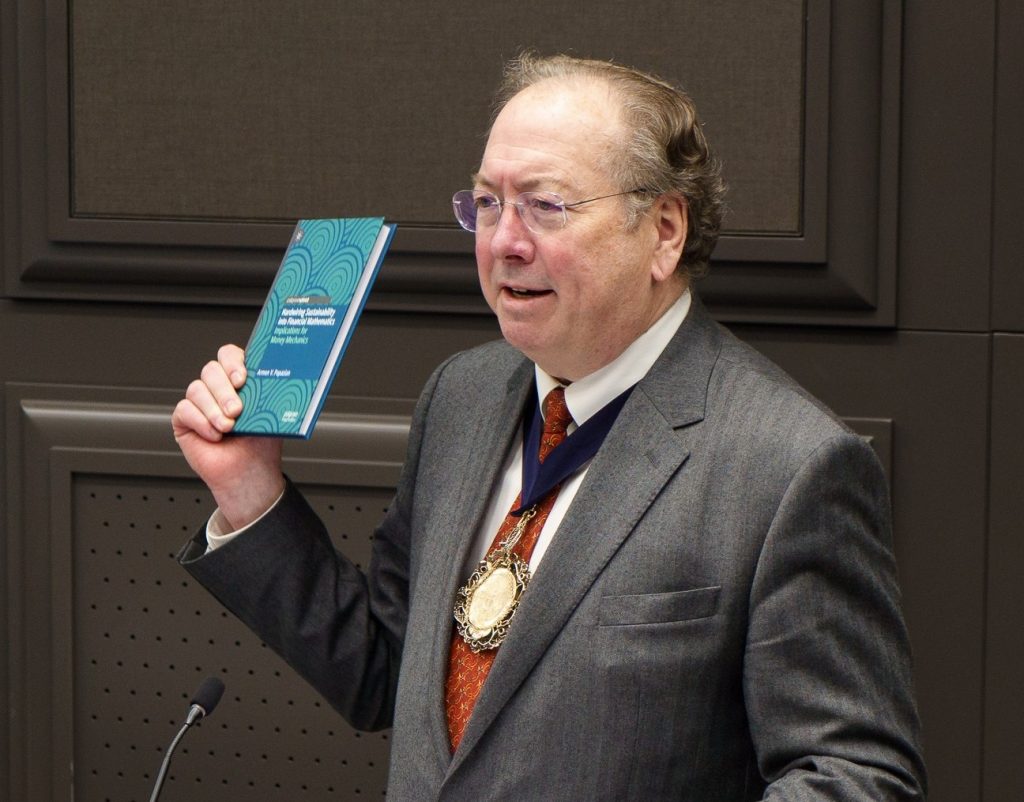

The launch event started off with an inspiring address by the 695th Lord Mayor of the City of London, Alderman Professor Michael Mainelli. The Lord Mayor showcased key achievements of the City of London in relation to Net Zero and the relevance and importance of Dr. Papazian’s work on hardwiring sustainability into financial mathematics. Below you can find the text of the Lord Mayor’s address.

Good evening and thank you to the Chartered Accountants for hosting us today.

For those who don’t know me, I’m Professor Alderman Michael Mainelli, the 695th Lord Mayor of the City of London…the world’s oldest democratic workers’ and residents’ cooperative, and I’m thrilled to join you for the launch of Armen’s new book, Hardwiring Sustainability into Financial Mathematics.

Thrilled, especially, as I have only just returned from COP28 in the UAE, where I highlighted the critical role the City must play in meeting our global climate goals.

As a scientist by trade, my mantra is “trust the science”. And when it comes to climate change, the science is all too clear… 1.1˚C of warming has already resulted in devastating impacts for people and for the planet, and, if we fail to make changes, by the year 2100, 50-75% of the world population will be exposed to periods of “life-threatening climatic conditions”.

Armen’s book is an interesting exploration of the case for hardwiring sustainability into financial mathematics, and I would agree that space and our responsibility for impact should be integrated into our equations of value and return.

As you say, Armen, if we’re serious about reaching net zero, sustainability must be achieved at the level of our monetary architecture as well as our products, businesses, and instruments, public and private…and, if investors must make responsible and sustainable choices, so must money creators.

Armen, I share your concern about the popularity of ineffective sustainability ‘non-solutions” and agree that…in the face of such a monumental challenge…the time for playing things safe is over. To quote you…we need to find effective long-term solutions which, “more often than not, imply and require radical transformations in us, in our values, practices, models and beliefs.”

My theme as Lord Mayor, “Connect To Prosper”: celebrating the “Knowledge Miles” of our Square Mile, the world’s Coffee House, focuses on how the City can help tackle global challenges through the power of positive connections…. and I believe that collaboration is key to developing those effective long-term solutions to climate change you speak about.

It’s something the City has known for a long time.

Though our streets are steeped in history, we couldn’t be more committed to protecting our planet’s future.

We were the first local government body to introduce a clean air act in 1953. We were at the Earth Summit in Rio in 1992, and have been at every meeting of COP.

The City Corporation has slashed its net carbon emissions by 66% since 2018 and is on track to reach net zero in its own operations by 2027…while pursuing a target of net zero for the whole Square Mile by 2040.

More broadly, the UK has established itself as a one-stop-shop for green finance. Combining scientific excellence and financial expertise in one location, we’re the only financial centre that leads in conventional and green finance rankings.

A reputation we hope to build on by advocating for innovative “transition finance” mechanisms – carbon and nature markets… voluntary carbon offtake agreements…sustainability-linked instruments and funds – that will support high-emitting companies on the path to net zero.

The City is acutely aware of the role it must play in financing a just transition…and conscious of the tremendous convening power we hold as the preeminent international global financial centre.

And, on that note, at COP I was delighted to announce that the City Corporation will bring key stakeholders from across the globe together for the Net Zero Delivery Summit in London in June next year.

Now in its third year, the Summit will help ensure we maintain a laser-like focus on delivery at the critical mid-point between COP28 and COP29.

The forum provides an opportunity for the private sector to take stock of progress and reflect on best practice…and will cover crucial topics: from the scaling up of the carbon emission market from 23% of global emissions covered by carbon pricing schemes, to the role of nature finance.

The City is home to 40 learned societies, 70 higher education institutions, 130 research institutes, and over 24,000 businesses…with more than 300 languages spoken.

So, this year’s Summit will focus on the role private sector science and tech solutions can play in reaching net zero. I hope to see many of you there…and I think your innovative thinking could add an interesting dimension to our discussions, Armen.

Congratulations, once more, on the publication of your book…which sets out a compelling argument as to why we should integrate responsibility and sustainability into our core finance value models.

Friends,

In 1987, the United Nations Brundtland Commission defined sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs”.

Though our views on the best pathway to net zero may differ in some areas and converge in others, I think we can all agree with this sentiment.

To quote you once more, Armen, “as disappointed as one may be by humanity’s current failings, we must steer clear of a deeper hopelessness”. I’m hopeful that…if we come together…we will prosper and preserve our precious planet for future generations.

Thank you, all, for your time. It’s been a pleasure to talk to you today.

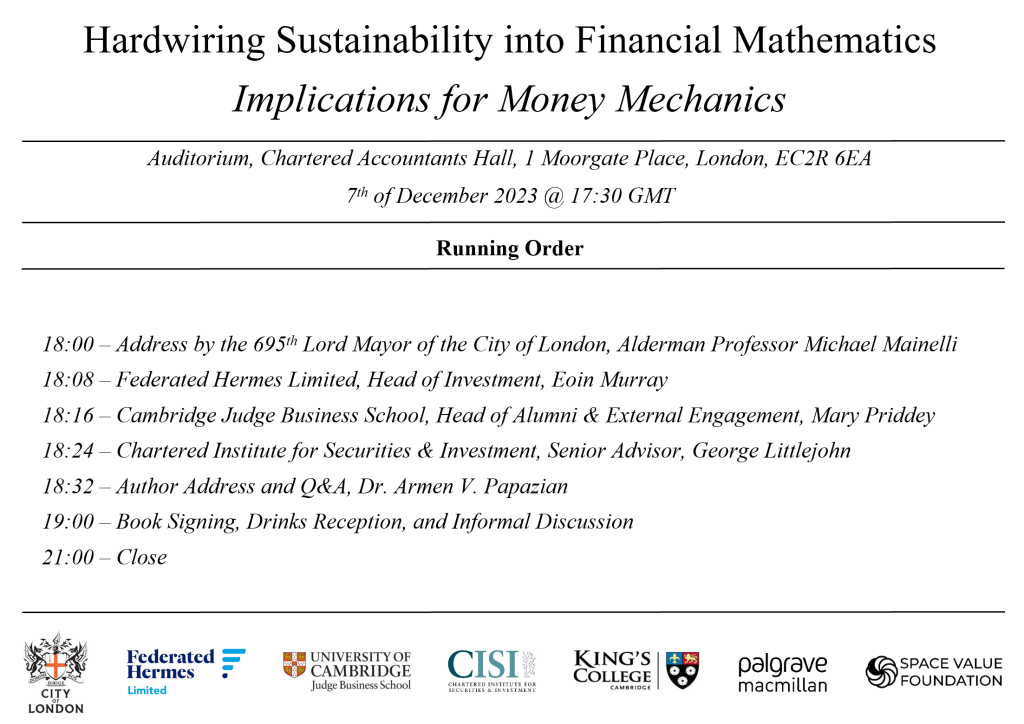

Event Agenda

About the Book

A ground-breaking work that addresses a crucial challenge facing our planet and the finance discipline, this book discusses key omissions in finance theory, principles, and equations, and explores recent developments in sustainable finance/ESG integration. It reveals a spaceless analytical framework and a sustainability debate that avoids the very logic of money creation. A theoretical treatise on sustainability in finance, the book makes the case for the hardwiring of sustainability into financial mathematics, offering a complementary principle and new equations for the purpose, while also discussing the implications of such a transformation for money mechanics.

CJBS Announcement

The Cambridge Judge Business School has recently published a news announcement regarding the forthcoming release of the book and this launch event – Hardwiring Sustainability.

CISI Article

The Chartered Institute for Securities & Investment has recently published an article by Dr. Armen V. Papazian that summarises the key arguments of his recent book – Sustainability and a space-adjusted mathematics of value and return.

About the Author

Armen is a financial economist, author, consultant and innovator with a track record in global finance and more than 20 years’ experience in sustainable finance, capital markets, and analytics. Armen is a Doctor of Financial Economics from Cambridge University and couples extensive advisory experience for financial institutions and markets with research into both the academic and practical aspects of sustainable finance challenges. More

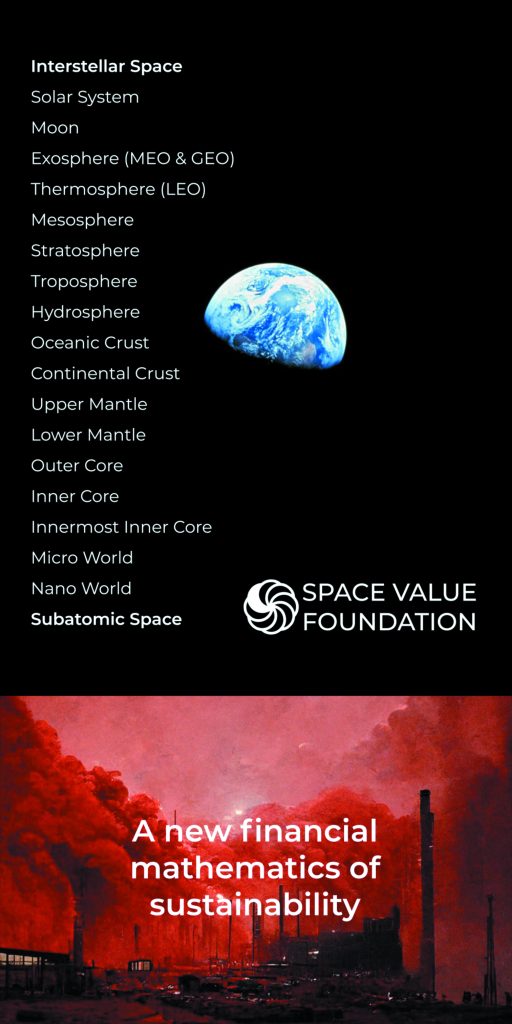

He is the author of The Space Value of Money: Rethinking Finance Beyond Risk and Time (2022) and a founder of the Space Value Foundation, which campaigns to embed sustainability into the very core equations of finance, allowing a global transition in business and industry.

The Space Value Foundation takes its name from the principle and model proposed by Armen in his recently published book.